Estate Planning Attorney Offering Personalized Legal Solutions to Safeguard Your Tradition and Decrease Tax Obligation Effects

Are you looking for a relied on estate preparation attorney to shield your legacy and minimize tax effects? Let us assist you browse the intricacies of estate preparation and secure your future.

:max_bytes(150000):strip_icc()/175427861-56aa10c03df78cf772ac3880.jpg)

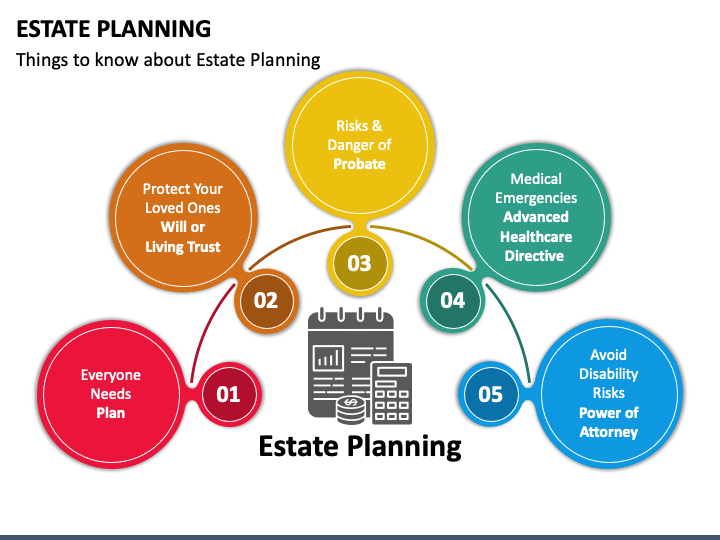

The Importance of Estate Planning

If you desire to protect your assets and make sure a smooth transfer of riches to your enjoyed ones, estate planning is necessary. Estate planning entails making vital decisions regarding exactly how your properties will certainly be distributed, who will handle your events if you come to be incapacitated, and also that will care for your small kids if you pass away. By functioning with a skilled estate preparation lawyer, you can make sure that your wishes are adhered to, your loved ones are offered for, and your possessions are shielded.

Comprehending Tax Obligation Effects in Estate Planning

To fully safeguard your possessions and make certain a smooth transfer of riches to your loved ones, it is vital to understand the tax obligation effects associated with estate preparation. Estate preparation entails making crucial decisions regarding how your properties will be dispersed after your fatality, but it likewise encompasses just how tax obligations will certainly affect those distributions.

One vital tax factor to consider in estate planning is the inheritance tax. This tax obligation is enforced on the transfer of residential property upon fatality and can considerably lower the quantity of riches that is passed on to your beneficiaries. Comprehending estate tax obligation regulations and guidelines can assist you reduce the effect of this tax obligation and optimize the amount of wide range that your liked ones will obtain.

One more tax obligation effects to take into consideration is the funding gains tax. When certain possessions, such as stocks or actual estate, are marketed or moved, capital gains tax might apply. By tactically intending your estate, you can capitalize on tax obligation exemptions and reductions to reduce the capital gains tax obligation concern on your recipients.

Furthermore, it is necessary to recognize the present tax, which is imposed on any kind of presents you make during your lifetime. Careful planning can aid you browse the gift tax obligation rules and make certain that your presents are given in one of the most tax-efficient means.

Methods for Protecting Your Heritage

By partnering with a skilled estate planning lawyer, you can efficiently guard your legacy with personalized legal methods tailored to your particular needs. These techniques are created to make certain that your properties are shielded and dispersed according to your wishes, while minimizing possible conflicts and obstacles from recipients or lenders. One essential approach is the production of a comprehensive estate plan that consists of a will, trust fund, and powers of attorney. A will allows you to assign how your properties will be distributed upon your death, while a count on can provide extra security and control over the circulation of assets. Powers of lawyer allow you to assign a person you trust to make financial and medical care choices in your place in the event of inability. Another important technique is the use of gifting and philanthropic providing to reduce the size of your estate and lessen estate tax obligations. By gifting assets to enjoyed ones or charitable organizations during your lifetime, you can not just minimize your estate's taxable worth but likewise attend to your family and support causes that are very important to you. Furthermore, establishing a household minimal partnership or limited obligation business can aid safeguard your properties from prospective financial institutions and provide for the smooth transition of possession to future generations. Generally, collaborating with a skilled estate planning lawyer can provide you with the comfort knowing that your legacy is safeguarded and your wishes will certainly be performed.

How an Estate Preparation Attorney Can Aid

One essential method an estate planning lawyer can assist is by giving personalized legal advice to make certain that your assets Home Page are secured and dispersed according to your dreams while lessening potential disputes and difficulties. Estate planning can be an intricate procedure, and having a lawyer on your side can make all the difference.

First and leading, an estate preparation attorney will certainly pay attention to your particular goals and concerns. They will take the time to comprehend your one-of-a-kind circumstances and tailor a strategy that fulfills your requirements. This tailored approach guarantees that your dreams are precisely mirrored in your estate plan.

Additionally, an estate preparation lawyer will certainly have a deep understanding of the lawful needs and regulations surrounding estate planning. They will certainly keep up to date with any kind of adjustments in the law that might influence your plan - estate planning lawyer garden city ny. This knowledge allows them to make sure and browse prospective mistakes that your plan is lawfully audio

Furthermore, an estate preparation attorney can assist decrease tax obligation implications. They will have understanding of tax obligation laws and approaches to aid you optimize your estate's value and reduce tax obligation worries for your beneficiaries.

In the unfavorable occasion of challenges or conflicts to your estate plan, a lawyer can offer the needed advice and depiction - estate planning garden city ny. They can help solve disputes and shield your wishes from being neglected

Individualized Legal Solutions for Your Details Needs

Obtain customized legal remedies to resolve your specific needs with the help of an estate preparation lawyer. websites Estate preparation is a complex process that calls for mindful factor to consider of your special circumstances and objectives. A knowledgeable lawyer can supply customized advice and produce a comprehensive strategy that safeguards your legacy and lessens tax implications.

An estate planning attorney will certainly take the time to pay attention to your problems, comprehend your goals, and evaluate your present circumstance. They will after that develop a customized plan that resolves your distinct conditions. This might involve creating a will or count on, establishing powers of lawyer, designating beneficiaries, or implementing strategies to decrease inheritance tax.

By collaborating with an estate planning lawyer, you can make certain that your properties are distributed according to your dreams, your liked ones are provided for, and your tax obligation liability is decreased. They will certainly browse the complexities of estate regulation in your place and give you with satisfaction understanding that your legacy is secured.

Don't leave your estate preparing to opportunity. Seek advice from with go to website an estate planning attorney to get tailored lawful remedies that are tailored to your particular requirements.

Conclusion

Finally, hiring an estate preparation attorney is vital to securing your legacy and reducing tax obligation effects. With their competence, they can give personalized legal remedies customized to your details requirements. By understanding the significance of estate preparation and the methods for shielding your possessions, you can make certain that your loved ones are looked after and your dreams are supported. Do not wait, get in touch with an estate preparation lawyer today to secure your future.

Are you looking for a relied on estate planning attorney to protect your tradition and minimize tax effects?One vital tax obligation consideration in estate preparation is the estate tax obligation. One more crucial method is the usage of gifting and charitable providing to decrease the size of your estate and reduce estate taxes.Furthermore, an estate planning lawyer will certainly have a deep understanding of the legal demands and policies bordering estate planning.In final thought, working with an estate planning attorney is crucial to securing your legacy and reducing tax obligation ramifications.